Partnerships, Innovation & Whole Child Support

Page Navigation

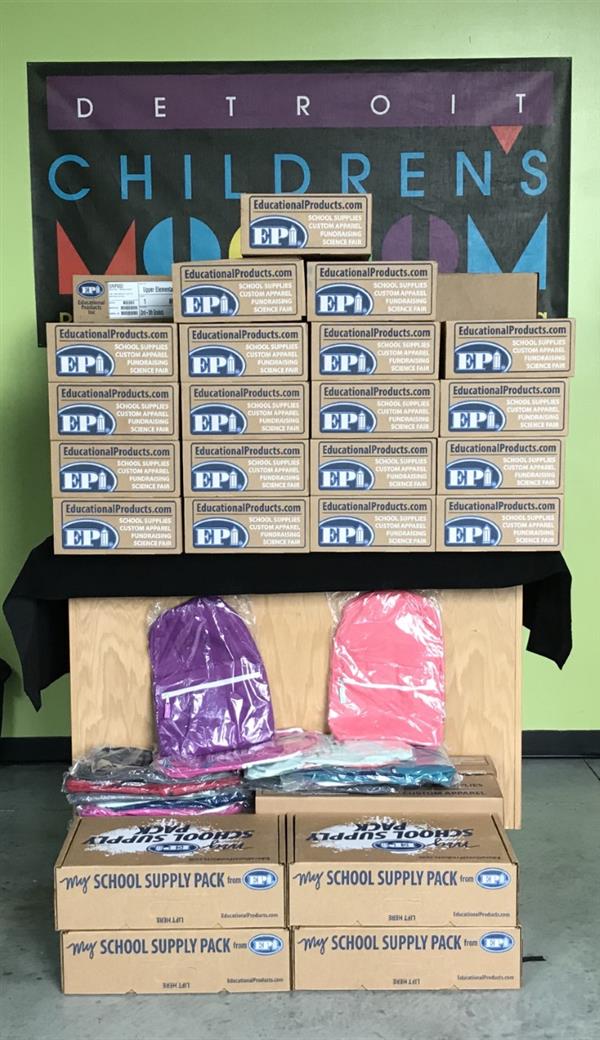

Donations

-

Thank you for your interest in donating to Detroit Public Schools Community District. We appreciate your support!

Each year, the District receives a wide array of monetary and material donations that support its priorities. Our goal is to make the donation process as straightforward as possible for the donor and ensure that contributions are leveraged for maximum impact. Donations to the District and its schools are tax deductible under section 170(c)(1) of the Internal Revenue Code.

Any time you make a material donation valued at more than $50 or a monetary donation of any size, the District employee accepting the donation should complete the Internal Donation Reporting Form to log it. Please share your email address with that staff member so that you receive an instant confirmation of the donation along with information for tax reporting.

Please Note: Any monetary donation of $10,000 or more should be routed to the Finance Department, and will be set up as a grant account string through Finance to ensure greater transparency and monitoring. If the donation is less than $10,000, it can be received and monitored at the school level, but still must be recorded through the Internal Donation Reporting Form.

Guidelines

-

- We reserve the right to decline donated items. Reasons for declining a donation may include, but are not limited to, space constraints at storage facilities and items not aligned to the District's needs.

- We do not accept broken or damaged items or items with missing parts.

- We can accept donations of money, goods, and supplies. Time and service are not tax deductible and should not be logged as donations; they generally require a partnership agreement with the District. Please note that, in accordance with IRS regulations, establishing the monetary value of donated items is the exclusive responsibility of the donor.

- Technology donations require the approval of the district's Asset Management and Deployment department. With questions about how to get approval for a donation of technology, please email DPSCD.Partnerships@DetroitK12.org.

How to Donate

-

- You can give directly to a school or central office department.

This expedites the process and helps ensure that donations are aligned with the school’s or department’s specific needs. This website includes full lists of schools and departments.

- You can contact the Partnerships Office for guidance.

If you need additional guidance or support to facilitate a donation, please email DPSCD.Partnerships@DetroitK12.org or call (313) 873-8595.

- Any time you make a material donation valued at more than $50 or a monetary donation of any size, the District employee accepting the donation should complete the Internal Donation Reporting Form to log it. Please share your email address with that staff member so that you receive an instant confirmation of the donation along with information for tax reporting.

- Please Note: Any monetary donation of $10,000 or more should be routed to the Finance Department, and will be set up as a grant account string through Finance to ensure greater transparency and monitoring. If the donation is less than $10,000, it can be received and monitored at the school level, but still must be recorded through the Internal Donation Reporting Form.